All-in-One Loan Management, HR, Payroll & Accounting Software

Project Information

-

Clients

Willo Comapny

New York - Start Date 1 July 2022

- End Date 25 July 2022

- Duration 160 Hours

Project Details

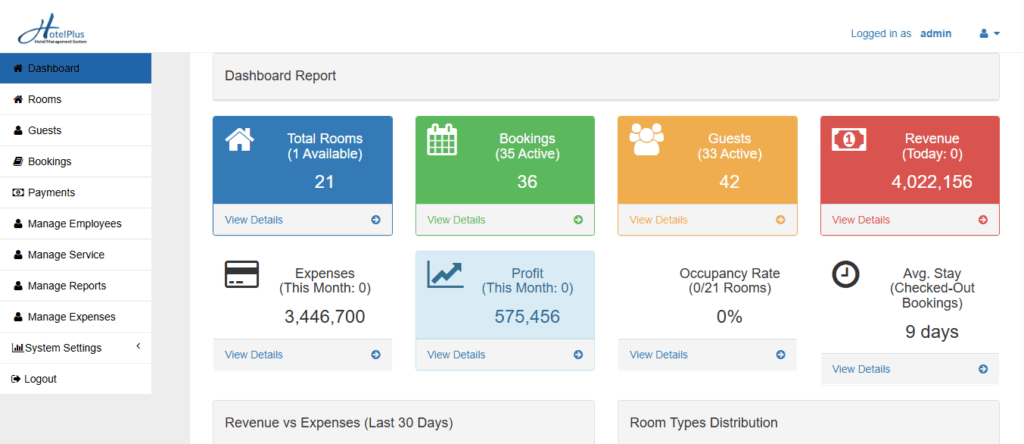

Simplify Lending Operations, Employee Management & Finances in One Platform

Streamline your financial institution, microfinance company, or lending business with our integrated Loan Management, HR, Payroll, and Accounting Software. Automate repayments, track employee records, process salaries, and manage books seamlessly—all from a single, cloud-based dashboard.

🚀 Key Features

💵 Smart Loan Management

- Automated loan origination & approval workflows

- Flexible repayment scheduling (daily, weekly, monthly)

- Late payment penalties & reminders (SMS/Email)

- Collateral tracking & risk assessment

- Multi-branch & agent support

👥 HR & Employee Management

- Employee database with documents & contracts

- Leave & attendance tracking (Biometric/Facial recognition integration)

- Performance & appraisal management

- Training & compliance tracking

💰 Payroll Processing

- Automated salary calculations (tax, deductions, bonuses)

- Payslip generation & direct bank transfers

- PF, ESI, and statutory compliance

- Loan recovery via salary deductions

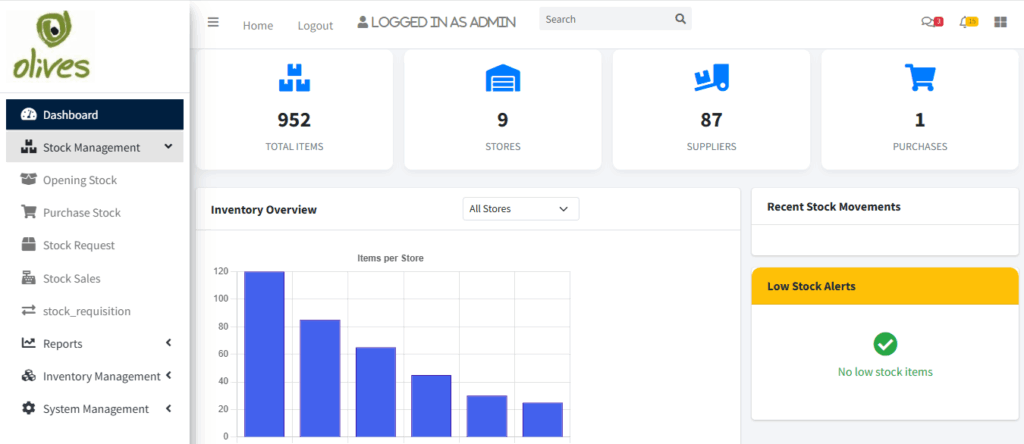

📊 Basic Accounting & Reporting

- General ledger & double-entry bookkeeping

- Income/expense tracking

- Financial statements (P&L, Balance Sheet, Cash Flow)

- Tax filing & GST compliance

🔒 Security & Compliance

- Role-based access control (Admin, Loan Officer, Accountant)

- Audit trails & data encryption

- RBI & NBFC compliance features

⚙️ Integrations

✅ Banks & Payment Gateways (Razorpay, Paytm, UPI)

✅ Credit Bureaus (CIBIL, Experian)

✅ Accounting Tools (Tally, QuickBooks)

✅ Biometric Devices (ZKTeco, Matrix)

💬 Customer Success Stories

⭐ “Reduced Loan Processing Time by 70%!”

“Our loan approval cycle went from 3 days to just 4 hours. The automated workflows and document tracking made all the difference.”

— Rajesh P., Microfinance CEO

⭐ “Seamless Payroll & Loan Recovery”

“Salary-linked loan repayments eliminated defaults. The payroll system handles PF, taxes, and bonuses effortlessly.”

— Priya M., HR Head

⭐ “Perfect for Our Cooperative Bank”

“From loan management to accounting, this software covers everything. The RBI-compliant reports saved us audit headaches.”

— Vikram S., Bank Manager

💰 Pricing Plans (All-in-One Solution)

| Plan | Basic | Professional | Enterprise |

|---|---|---|---|

| Price | $149/month | $399/month | Custom |

| Users | Up to 10 | Up to 50 | Unlimited |

| Loans/Month | 500 | 5,000 | Unlimited |

| Payroll Employees | 50 | 200 | Unlimited |

| Support | Phone + Chat | Dedicated Manager |

🎁 Limited-Time Offer: First 3 Months at 50% Off!

🚀 Why Choose Our Software?

✔ End-to-End Solution – No need for multiple tools

✔ Cloud & Mobile Access – Manage on the go

✔ AI-Powered Risk Analysis – Smarter lending decisions

✔ 24/7 Customer Support – Implementation & training included

📞 Get a Free Demo Today!

[👉 Start Free Trial] [📞 Book a Consultation]

📌 Perfect For:

- Microfinance Companies (MFIs) 🏦

- Cooperative Banks 🏛️

- FinTech Startups 💻

- NBFCs & Credit Societies 📈

- HR & Payroll Teams 👥

Upgrade your lending and HR operations today! 🚀