Car Hire Purchase Payment System

Project Information

-

Clients

Willo Comapny

New York - Start Date 1 July 2022

- End Date 25 July 2022

- Duration 160 Hours

Project Details

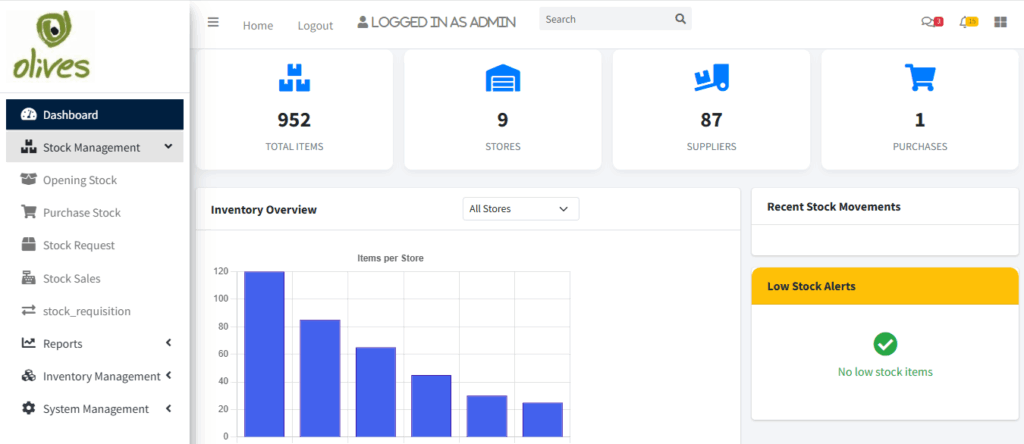

🚗 Car Hire Purchase Payment System

Empowering Car Dealerships & Financial Institutions to Manage Vehicle Installments with Ease

Our Car Hire Purchase Payment System is a comprehensive platform that streamlines the sale of vehicles through installment plans. It’s tailored for dealerships, microfinance institutions, and auto-financing companies managing hire purchase agreements, customer payments, loan tracking, and repossession workflows.

🧩 Core Modules & Functionalities

📝 1. Customer Registration & KYC

Register clients and capture all necessary Know Your Customer (KYC) documentation.

Key Features:

- Full customer profile: personal details, ID, occupation

- Upload documents (ID, proof of residence, etc.)

- Credit score/history records

- Blacklist & duplicate checks

🚘 2. Vehicle Inventory & Pricing

Manage available cars, pricing, and hire purchase setup.

Key Features:

- Vehicle listings with specs, price, and photos

- Hire purchase terms: deposit %, interest rate, payment period

- Set availability status (available, reserved, sold)

- Vehicle insurance and registration tracking

💰 3. Installment Payment Management

Monitor and automate all installment-related processes.

Key Features:

- Auto-generate monthly repayment schedules

- Partial, full, and early payment options

- Auto-calculate interest (flat or reducing balance)

- Grace periods, penalties, and overdue interest

- SMS/email payment reminders

- Payment receipts with audit trail

📊 4. Loan & Agreement Tracking

Centralize contract and payment tracking per customer.

Key Features:

- View outstanding balance and payment history

- Download/view signed agreements

- System alerts for defaults or delays

- Loan restructuring & early settlement functions

🏦 5. Finance & Accounting

Track income, interest earned, and outstanding receivables.

Key Features:

- Interest income reports

- Payment reconciliation

- Dealer or financier revenue breakdown

- Integration with accounting tools like QuickBooks

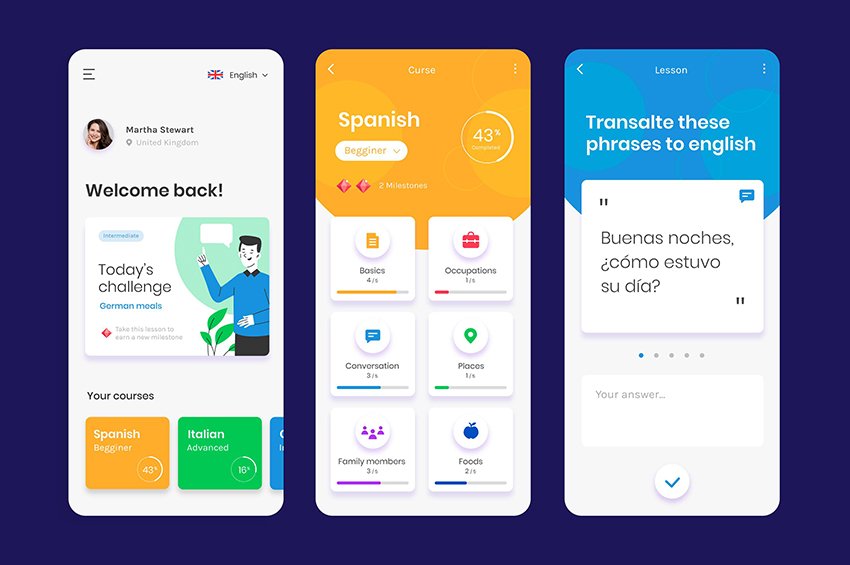

📱 6. Mobile Customer Portal (Optional)

Let customers check balances, pay installments, or view history online.

Key Features:

- Pay using mobile money, bank, or card

- View repayment plan and due dates

- Download receipts

- Raise support tickets or request early clearance

👤 Ideal for:

- Car Dealerships

- Microfinance Institutions

- Auto Loan Providers

- Credit Cooperatives

- Vehicle Financing Startups

💬 Customer Testimonials

⭐⭐⭐⭐⭐

“Our dealership went from manual records to automated hire purchase processing—no more lost files or missed payments.”

— James B., AutoSales Uganda

⭐⭐⭐⭐

“The SMS reminders and installment tracking have drastically reduced our default rate.”

— Faith N., Finance Manager, Wheels2Go

⭐⭐⭐⭐⭐

“As a small financier, we now offer flexible car payment plans professionally thanks to this system.”

— Michael T., Director, RideFlex Credit

📈 Business Benefits

✅ Reduce default risk

✅ Professionalize your car financing operations

✅ Gain full transparency in customer balances

✅ Improve compliance and record-keeping

✅ Boost customer satisfaction with payment convenience

🔒 Security & Compliance

- Role-based user access

- Audit logs

- Secure payment gateways (e.g. mobile money, bank APIs)

- GDPR/consumer data protection compliance

💻 Deployment Options

🖥️ On-Premise

☁️ Cloud-Based (SAAS)

🌐 Multi-branch Ready

📱 Mobile-Optimized

📞 Ready to Upgrade Your Car Hire Purchase System?

💬 Get a Free Demo Today and transform the way you manage car payments!

📧 Email:

🌍 Website:

📱 WhatsApp:

📅 Schedule a demo — No obligations!